For Advisors: a solution designed to deliver value while bringing held-away cash into your orbit

What is Flourish?

Flourish is a solution designed to deliver value while bringing held-away cash into your orbit, allowing advisors to deliver more value, unearth new assets and drive prospecting.

Today they work with over 750 RIAs and have over $4.5B in assets under custody≈ on their platform.

"Flourish Cash provides an easy way to provide your clients with a no minimum, no fee, FDIC insured (well above typical bank coverage), competitive yield cash account that's currently (as of March 14, 2024) paying 5% APY in the top tier. Their online interface is well designed and intuitive and I've had several clients sign up on their own after I sent them an email invite. Flourish also integrates with my CRM, Wealthbox, so I can easily send a Flourish invite to a client without having to retype any information. It's a great, easy, client-friendly alternative that is much better than they'll get at most banks."

-Russ Thornton

Flourish Cash† allows advisors to:

- Deliver more value

- Enhance short term planning and portfolio management decisions

- Interest earned could offset half of a typical client’s advisory fees

- Unearth new assets

- Visibility can start a conversation on how much cash is enough and open the door to moving funds to the portfolio∆

- Drive prospecting

- Engage prospects, including next-gen clients and business owners - backed by an invitation-only solution

Flourish Cash† Solution

-

- Invitation-only solution - available to both clients and prospects

- Branded with your logo

- Visibility into balances, statements, 1099s∆

- Easy to set up standing instructions (e.g. Schwab MoneyLink)

- CRM and Portfolio Reporting integrations

- Built-in referral engine

For Clients: a competitive yield cash management account

-

- Competitive variable rate

- Increased levels of FDIC Insurance through our Program BanksΩ

- Minutes to sign up

- $0 minimum

- No Flourish fees∫

- Unlimited Transfers

- Support for individual, joint, revocable trust, and business accounts

Advisor and Client Resources

-

- The Flourish - Wealthbox Integration allows advisors to pre-fill client applications and send invites with a click of a button - all from within Wealthbox. Check out their Wealthbox integration guide here.

- The Flourish - Redtail Integration gives advisors the ability to quickly pre-fill client applications in Flourish and invite clients with the press of a button using data stored in Redtail. Check out their Redtail integration guide here.

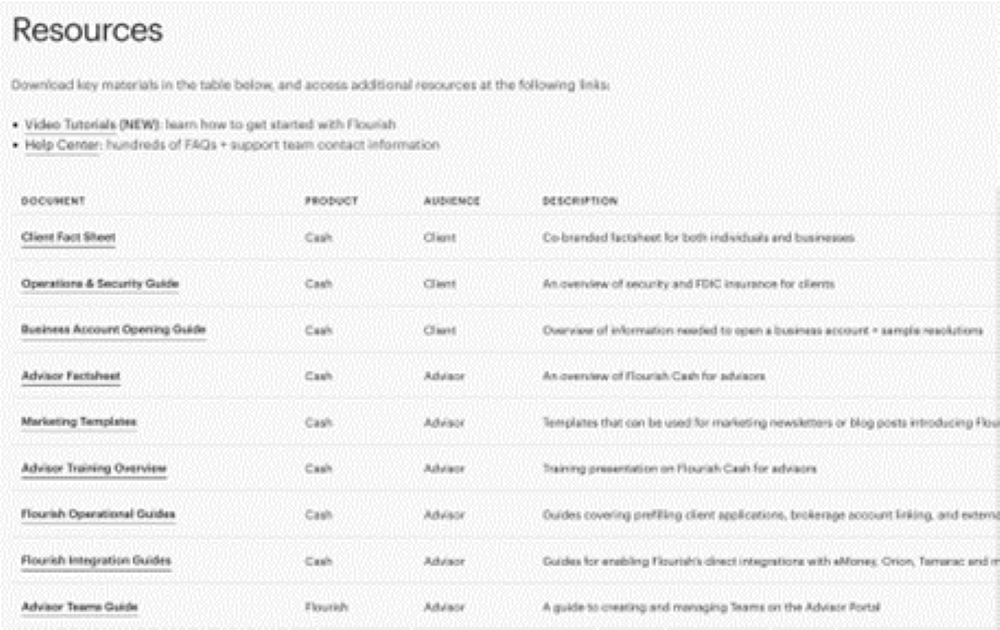

Resources tab of the Flourish Portal

-

- Client Fact Sheet - a branded fact sheet for both individuals and businesses

- Advisor Fact Sheet - an overview of Flourish Cash† for advisors

- Operations & Security Guide - an overview of security and FDIC insuranceΩ for clients

- Business Account Opening Guide - overview of information needed to open a business account + sample resolutions

- Marketing Templates - templates that can be used for emails, newsletters or blog posts introducing Flourish Cash†

Steps to Get Started

Email josh.grossberg@flourish.com and let him know you are interested in working with Flourish and that you are associated with Wealthcare.

Activate your Flourish Invitation sent to your email by support@flourish.com

- Set login credentials

- Set up 2-factor authentication

Invite Clients

- Invite Tab

- Fill in your client’s first name, last name and email address. You can add a household partner if they have one by clicking + Add household partner. When finished, click Continue.

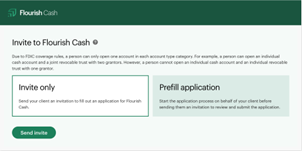

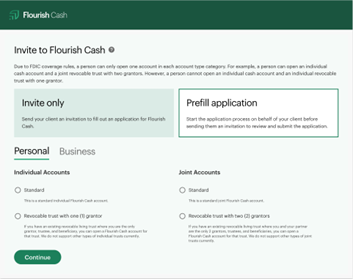

- Choose Invite Only or Prefill Application and click Continue. Invite Only will send your client an invitation to fill out an application for Flourish Cash†

Prefill Application allows you to start the application process on behalf of your client before sending them an invitation to review and submit the application. This option will allow you to choose an account type (standard individual/joint, individual/joint revocable trusts). For trusts you will have the ability to upload trust documents on behalf of your client.

Case Studies

Contact Information

Support Desk:

Advisors and end-clients can call (833) 808-5700 or email support@flourish.com for help with Flourish

Hours: Monday – Friday 9 AM – 5 PM ET

Flourish Relationship Manager:

Joyce Liu joyce.liu@flourish.com 718-215-9251

Flourish Director of Business Development:

Josh Grossberg josh.grossberg@flourish.com 646-970-1873

Note: This product is NOT approved by LPL.

FOR INVESTMENT PROFESSIONALS ONLY

"Flourish Cash currently has a tiered interest rate structure, as set forth in the rate tier summary. We deposit your cash with one or more of the Program Banks, subject to any Program Bank(s) you have excluded. You will earn the highest rate offered by Flourish up to the maximum deposit amount for each tier. Each annual percentage yield (APY) displayed here is effective as of 12/07/2023 and may change at any time. Your advisor may charge fees which impact the effective rate you receive on your cash; you should speak with your advisor for more information. The Flourish Cash interest rate(s) could be lower than the rate that could be earned by opening a deposit account directly with a Program Bank."

† A Flourish Cash account is a brokerage account offered by Flourish Financial LLC, a registered broker-dealer and FINRA member. Flourish Financial LLC is not a bank. Check the background of Flourish Financial LLC and its personnel on FINRA's BrokerCheck. The cash balance in a Flourish Cash account will be swept from the brokerage account to deposit account(s) at one or more third-party Program Banks that have agreed to accept deposits from customers of Flourish Financial LLC. The accounts at Program Banks will pay a variable rate of interest.

∆ An advisor’s ability to view client account information is subject to applicable privacy laws and clients' consent to such sharing.

∫ Your advisor may charge fees that are collected from your Flourish account; speak with your advisor for more information. Wire fees may apply.

≈ Assets include Flourish Cash client cash balances held with the Flourish Cash Program Banks as of 2/27/24

Ω The cash balance in a Flourish Cash account that is swept to one or more Program Banks is eligible for FDIC insurance, subject to FDIC rules, including aggregate insurance coverage limits. FDIC insurance will not be provided until funds arrive at the Program Bank. There are currently at least 20 Program Banks available to accept deposits for business Flourish Cash accounts and personal Flourish Cash accounts, and we are not obligated to allocate customer funds across more than this number of Program Banks if there is a greater number of banks in the program. Customers are generally eligible for FDIC insurance coverage of $250,000 per customer, per Program Bank, for each account ownership category. Thus, business customers are eligible for up to $5,000,000 of FDIC insurance and personal customers are eligible for (i) up to $5,000,000 of FDIC insurance for an individual account or revocable living trust account and (ii) up to $10,000,000 of FDIC insurance for a joint account with two owners or joint revocable living trust(s). The total FDIC coverage for a two-person household is calculated assuming that each household member has an individual account and that both household members share a joint account. If the number of Program Banks decreases for a customer (for instance, because a customer chooses to exclude Program Banks from receiving their deposits), the amount of FDIC insurance through Flourish Cash could be lower. Typically, all of a customer’s deposits at a Program Bank in the same ownership category (including deposits held outside Flourish Cash or held through multiple Flourish Cash accounts with the same ownership category) count toward the FDIC insurance limit for deposits at that Program Bank. Customers are responsible for monitoring whether they maintain deposits at a Program Bank outside of Flourish Cash and should consider choosing to exclude that Program Bank from receiving their deposits to avoid exceeding FDIC insurance limits. Although Flourish Cash is offered through a brokerage account and cash held in brokerage accounts often has the benefit of SIPC protection, until such time as we offer securities products, customers likely will not have the benefit of SIPC protection. SIPC protection is not available for cash held at the Program Banks. Our current Program Banks can be found here. For additional information regarding FDIC coverage, visit https://fdic.gov/.

Wealthcare Capital Management LLC, Wealthcare Capital Partners LLC, and Wealthcare Advisory Partners LLC (collectively, “Wealthcare”, “WCM”, “WCAP”, “we”, “our”, “us”) are registered investment advisors with the U.S. Securities and Exchange Commission (SEC) under the Investment Advisors Act of 1940. All Rights Reserved.

GDX360® is Wealthcare’s fiduciary process that integrates goals based planning with investment implementation that includes cost and tax management services designed to put clients first.

WealthcareGDX® and GDX360® are trademarks of Wealthcare Capital Management IP LLC.

This website is intended to provide general information about GDX360® as a WCM and WCAP service. It is not intended to offer or deliver investment advice in any way. Information regarding investment services are provided solely to gain an understanding of our investment philosophy, our strategies and to be able to contact us for further information.

All investment advisory and financial planning services are offered through WCM and WCAP. WCM and WCAP will maintain all applicable registration and licenses as required by the various states in which WCM and WCAP conducts business. WCM and WCAP render individualized responses to persons in a particular state only after complying with all regulatory requirements, or pursuant to an applicable state exemption or exclusion. Click here to see the full list of disclosures.